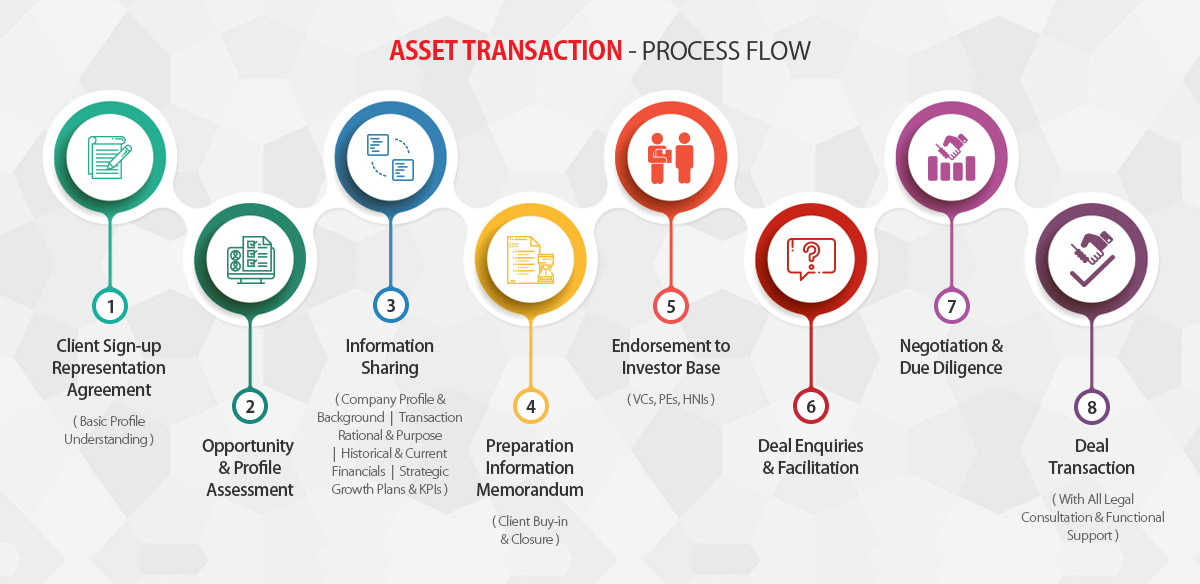

REQUIREMENT

Equity India would carefully understand the Client’s requirement which would include -

- Client’s Business/Company profile, its values and historical background

- The Purpose of a Financial Investor

- Historical & Current financials

- Strategic KPIs - Marketing and Expansion plans & other critical information

Post finalization and sign-up of engagement agreement, Equity India would share an information request list for fulfillment.

- Equity India would also prepare a detailed Financial Model to determine the Valuation of the Business, to estimate a reasonable indicative range of the values ("Price band") that could be realized in the proposed placement

- This base valuation will form the basis for negotiating the price with the potential Investor. Valuation Techniques such as Discounted Cash-flows Analysis, EBITDA Multiple and Earnings based valuation will be employed in addition to valuations based on comparable transactions, to provide a range of benchmark values.

- Equity India along with necessary inputs from the Company, will prepare a brief note on the opportunity, which will be sent to the Investors to gauge their prima facie interest in the Transaction

- If the Investor seeks to examine the opportunity further, confidentiality is signed between the Investor and the Company

- A descriptive Information Memorandum (IM)/Pitch Book will be shared with the Investor.

- Equity India will endorse the opportunity to its Investor base and will consult with and advise the Company concerning opportunities. If requested by the Company, Equity India will also participate on company’s behalf in negotiations during the transaction.

-

It will assist the Company in negotiating with the selected Investors and structuring the deal with respect to:

- Financial terms and conditions

- Legal documentation

- Advice on the overall Capital Structure

- Closure of the Transaction